Arlene Isenburg

Trying to get a home loan can be a bit frightening, particularly if you are not used to the process. In addition to, whom would not be scared making reference to this much money? However, training and you may making preparations yourself takes a few of the anxiety away.

In this post, we will speak about how-to get ready to fulfill having lenders. However, earliest, let us discuss the borrowed funds processes and how to choose the right lender to you.

What Must i Perform Before I Correspond with a loan provider?

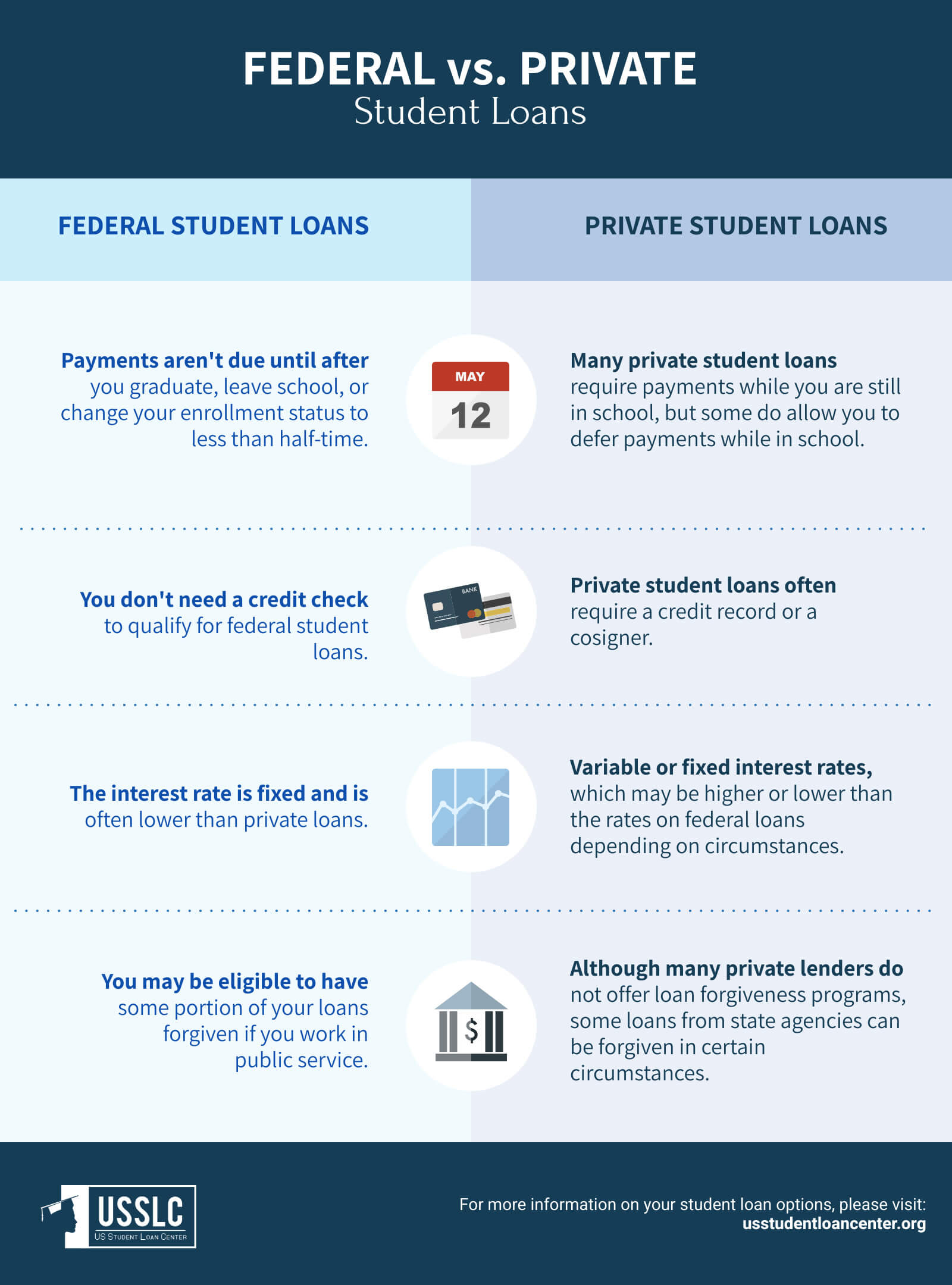

A mortgage lender is actually a lending institution that offers lenders the real deal estate requests and you will refinances. They supply a loan which have attention, therefore repay the borrowed funds in addition to interest (also any charges and you may insurance rates) during the period of the borrowed funds until its paid down entirely. Some lenders also offer other sorts of financing, instance personal loans otherwise student loans. The sorts of lenders is actually financial institutions, private/non-bank lenders, money now usa installment loans borrowing unions, and brokers.

Banking institutions : Really finance companies offer fund on their patrons, and be also eligible to home financing disregard only to own banking together with them. But banking companies tend to have large rates than other loan providers as well as usually takes extended to close in your financing merely due to just how hectic he’s.

Borrowing from the bank unions : Since most borrowing from the bank unions try nonprofits, they have a tendency to offer the reduced cost. However, only players meet the criteria to have financing, rather than everyone is permitted getting a part. And for individuals who are eligible, funds may not be readily available, as the borrowing from the bank union may reduce number of fund they reveal to you.

Lenders : Home loans are not real loan providers. He is wade-betweens who let individuals comparison shop to find the right financial and you will loan in their mind. You might always run any sort of you prefer.

Once you influence that you have to have that loan, try to keep in touch with loan providers to start the process. Locate loan providers, you could potentially pose a question to your family, friends, colleagues, and you can real estate professional who have become through the processes. They might bring advice, or they might help you because of the revealing the way they located the financial and you can whatever they wanted within the a lender. If you don’t have you to definitely ask, there are also loan providers thanks to an internet browse or explore a mortgage broker. Please remember to inquire of the banking institutions/loan providers that you already use. You ought to keep in touch with loan providers before generally making a keen offer on the a home, as processes can take very long, and also you you will definitely overlook a home.

Just like the additional loan providers can offer different money, you need to consider various lenders to understand more about all of your current choices. Generate a summary of lenders you would like to talk to, contact as much as you would like (shoot for at the least around three), build appointments with financing officers and implement. Even though your apply and you may meet with a loan provider does not indicate you ought to get that loan as a consequence of all of them. These are just educational conferences for of your own work for. Meeting with many loan providers makes it possible to keep the possibilities discover, get the most facts about the individuals solutions, and also choose the best mortgage manager to utilize.

During the group meetings, bring your economic data files, and be truthful, unlock, and you may sincere. Dont lay. They are going to read anyhow, plus it make a difference the loan qualification. And additionally, sleeping will not carry out often group a good buy. At this time of the techniques, the greater number of advice you can promote, the greater. Let them know what you are looking, find out the interest levels and charge, have them examine your files and get the type in as well. They might inquire to accomplish a credit score assessment. This is your choice to ensure it is or otherwise not make it. But understanding your credit rating enables the financial institution to produce particular factual statements about all the different financing options and you will financials, and additionally they ine your credit history getting errors. Keep in mind that checking your borrowing from the bank will cause your credit score to shed briefly, but there is a great forty-five-day window where numerous lenders can look at your credit history without producing more out of a drop in your get.