To buy a property is a primary feel for the majority people’s lifestyle – and also one which might be costly and tiring. However, just how costly and you will tiring its can also be count on how you prepare for the property buying processes. A proven way you can do this – whenever you are saving yourself currency and reducing your payment months – is through preparing a significant-size of put. Needless to say, this will be easier in theory. Here is as to why saving getting more substantial put are a good idea and a few important tips on the way to get it done.

What makes a larger put best?

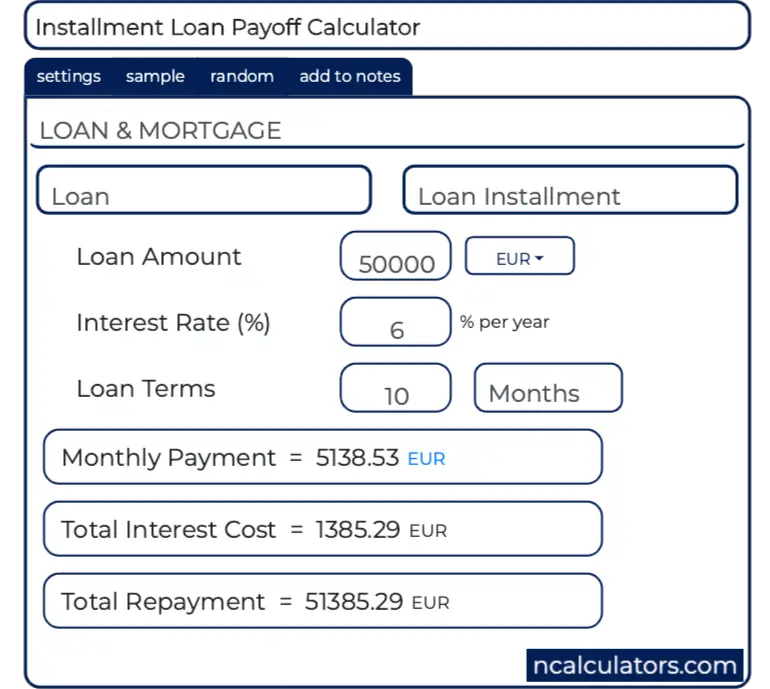

A deposit consists of the amount of money you add forward due to the fact a good advance payment to the buying a house. Once you pick a house with financial help, you are able to deduct this put number in the property’s price tag, and by expansion the latest finance number you sign up for. A larger put can cause lower monthly payments or a good less fees several months. Monetary Loan providers can observe software which have more substantial put a great deal more favourably that you can mean that you’re finest open to the acquisition otherwise establish less risk on them.

The initial step with the preserving for in initial deposit are function a finances. This will inform your deposit size compared in order to an effective property’s asking price. It is vital to understand that you happen to be anticipating repayments you will be and then make over the second pair many years. Given that life is volatile, calculating in initial deposit sum within large end of the spectrum can provide economic leeway when it comes to affordability, helping you weather upcoming financial storms instead normally stress on your life style and you will finances.

Strategies for saving a more impressive put

Storing money monthly once you have started reduced is the absolute 1st step on protecting to your a deposit. Listed below are some alternative methods you could add to this amount:

- Improve your account

Most people make month-to-month continual payments toward tips such as for instance mobile agreements, homeowners insurance and you can internet sites relationships. You’ve got come paying them for a long time, instantly taking their annual rate grows of comfort. Delivering inventory each and every repeated payment you create makes it possible to determine if every one nevertheless suits you or if you is terminate or downgrade them. Because of the revisiting their insurance policies you could find you qualify having a no-claim incentive or price fall off as the a lengthy-time customers. Whether or not it doesn’t apply at you, you might identify opposition that provide you with a Movico quick cash loans comparable exposure otherwise features you currently fool around with however, on a lesser rates.

- Display classification information

In terms of and come up with most requests, there clearly was power in the teams. Having a team of friends, co-pros or neighbours contribute into the just one shared pick is also lower per product’s cost for each domestic. An easy way to take action is through to get food or almost every other domestic requirements in bulk directly from a dealer otherwise store and you will sharing the price certainly several individuals. It can also use the style of discussing an individual money otherwise provider between several anyone. Including, a group can pay for a full-time horticulture or cleaning services in which one individual spends the service for two weeks prior to passage they to the next individual.

- Exchange and sell

Really home possess a rack otherwise several filled up with bare factors that will be taking on rewarding storing and event soil. This can may include child items your high school students possess outgrown to presents from a family member you’ve got zero use getting if not sporting events devices you don’t had around to using. Discover other sites and you may social networking groups where you could promote utilized however in an excellent-position products for extra dollars. You are able to these exact same groups to buy issues you desire from the a low price. For example pricey but essential requests including products, equipment and you may chairs.

- Go chicken-free

Southern Africans was a nation out of animal meat people and many regarding us think about it are a staple element of each meal. Because dining will cost you have raised for the past month or two, phasing aside or lowering your meats application you’ll shrink your own searching costs. You can begin by having someday away from chicken-free foods a week while increasing this new volume as you turn into even more always vegan cooking and you can buffet thinking. In many cases, using a far more varied diet full of fresh produce can also be get healthy effects, that’ll in turn qualify your certainly medical services advantages.

- Enable it to be fun

Although you be aware that that have a larger put commonly feel good, you can reduce eyes of objective while in the each and every day life. Once you begin so you can go without food otherwise scale back on certain enjoyable expenses, you could potentially feel just like you will be depriving on your own. Occasionally, this may allow you to briefly otherwise permanently dump those protecting currency strategies. To keep yourself on course, you’ll need to result in the process because fun and you may enjoyable since it is possible to. Such, you could make a wager having loved ones otherwise co-pros towards the who will save your self the most currency every week and also use all of them once the responsibility family to keep you against making a lot of purchases.

- Remove convenience commands

Many of the factors i purchase or attributes i play with provides been picked because of the all of us while they generate our everyday life smoother and you will more convenient. Sadly, which benefits come with added will cost you, that is why downgrading this type of requests can save you currency. It could be as simple as forgoing pre-slash fruits & vegetables getting entire, unwashed new generate otherwise using doing all of your fingernails at home in lieu of rescuing time and having them accomplished by an expert more than the lunch time.

The guidelines mentioned above are only specific methods boost the money you save to your property buy put. It may take time and give up nevertheless when you protected your household during the a less expensive rate, you will never be sorry. SA Lenders can help you most useful prepare for the whole process and you will make suggestions courtesy they. Get in touch with we now for additional great tips on what you want to learn – or give us your details and we will label your back.