You to definitely staff members does surge whenever rates of interest was reduced and you may houses directory are abundant, and you will sense evident jobs cuts whenever ascending interest rates and tight index provides dissuade to acquire and you will refinancing.

Experts say Wells Fargo or other federal and you will very-regional banking companies have lost share of the market to help you on line creditors, such as Skyrocket Financial, Joined Coast Monetary and Mortgage Depot.

When computing by value of money, Wells Fargo was third during the $159 mil, JPMorgan are fifth within $134 billion and Lender of The usa Corp. is actually 7th in the $85 million.

Bloomberg Information claimed for the a keen Aug. 14 post you to Wells Fargo is actually take straight back from taking loans to possess mortgages produced by 3rd-class loan providers, including serving Government Construction Management finance.

However,, I suppose my section are we are really not trying to find getting extraordinarily high throughout the mortgage company just for the purpose of being on the home loan team.

Not alone

The mixture of far more fintech lenders, tightened financing standards because property ripple burst out of 2008-11, and a-sharp slip-out of so far this season when you look at the refinancing hobby enjoys other banking companies questioning the character and size throughout the market.

The newest Financial Lenders Association’s financial declaration, put out Aug. twenty two, receive the home loan originations provides fell forty eight% off step 3.55 million regarding the next one-fourth from 2021 to just one.85 billion throughout the second quarter from 2022.

Truist head monetary administrator Daryl Bible told you into the bank’s meeting name which have experts you to high interest rates is actually pushing financing quantities and get-on-purchases margins.

Truist chief executive Expenses Rogers advised analysts that financial most likely (is) a little flat last half of the year (compared to) the first half the entire year.

Tim Wennes, chief executive of one’s U.S. office to have Santander, advised CNBC that bank’s choice to go away domestic home loan financing during the February try driven mostly by the lowering of financial amounts. This has put its credit work with automobile finance, that are giving high efficiency.

For the majority, particularly the quicker institutions, the vast majority of home loan volume are re-finance hobby, that’s drying out up-and might drive an excellent shakeout, Wennes told you.

Fintech advantages and disadvantages

An instant and sleek method is the head aggressive virtue you to fintechs have more traditional banking companies, borrowing from the bank unions and other old-fashioned mortgage brokers.

Fintechs have built its life for the greatest making use of large data, analysis statistics, complex algorithms, and you may phony intelligence – hence allow alternative lenders to higher evaluate borrower’s creditworthiness and you can reach best online payday loan Ohio over the years under-served communities, wrote Sandra Lankford for the an excellent July 22 weblog on look enterprise Wolters Kluwer.

Some one and you can organizations complete their guidance on the internet otherwise because of an enthusiastic software, publish documents digitally, while having one point of exposure to the lender.

Option lenders commonly a good choice for all residential otherwise commercial consumers. Consumers search for an informed rates of interest and conditions, that can nevertheless are from finance companies.

Even in the event fintech businesses are recognized for technological developments and delivering characteristics including digital mortgage loans, advice shelter remains a premier concern, she told you. At exactly the same time, government entities will not control low-bank loan providers due to the fact firmly because banking institutions.

Brand new solutions

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

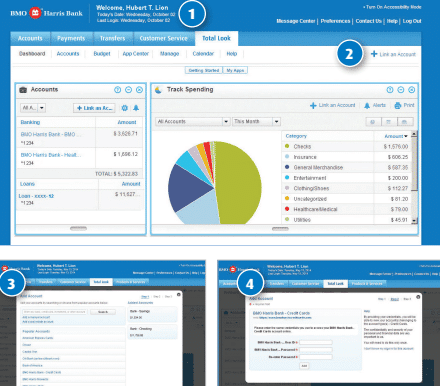

Of several traditional finance companies and you may credit commitment have responded to the fintech battle because of the trying to accept a number of the same big analysis statistics.

Such as for example, Truist might have been expanding on the an electronic-earliest method circulated inside the 2019 from the predecessor BB&T Corp. and its chairman and you can leader Kelly Queen.

First titled Interrupt otherwise die, the bank softened the term so you can Interrupt and you may prosper whilst plugged in fake cleverness and you will robotics towards the the right back-office, customer-provider and you can compliance surgery.