In this article

- What is actually a fixed-rates mortgage?

- Ought i augment my financial into the 2023?

- Whenever a predetermined-rate might not be wise

- What the results are whenever a predetermined financial identity finishes?

- Solutions so you can fixed-speed lenders

A property could be one of the biggest advantage requests might actually ever build that you know, this can easily repay to help make the proper decision with respect to choosing between a predetermined-speed and you may adjustable rates mortgage.

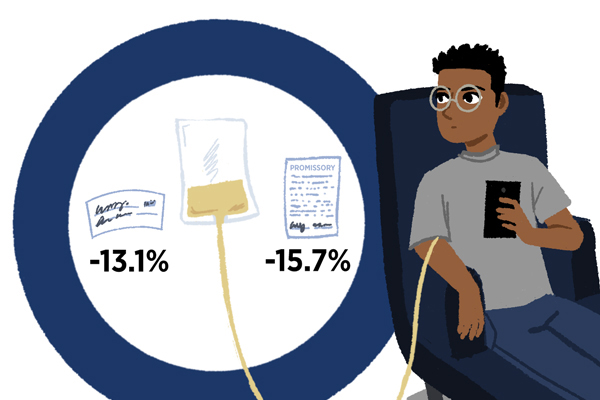

Of several borrowers are drawn to the certainty a fixed-rate home loan also provides – even We took out a 2-seasons repaired rate while i ordered my very first house. Inside mid-2021, the fresh new fixed-price lenders peaked on over fifty percent of your own sector, but have just like the dithered to help you fewer than one-in-ten lenders written in any given week.

Repairing the loan can be a practical choice for those who have to insulate by themselves away from any possible interest rises. However,, there are even some instances where a fixed-rate is almost certainly not just the right alternative.

Right here, i view exactly what it way to your residence financing, advantages and cons, whether or not repairing is definitely worth it, and also some alternative options to repaired-cost.

What is a predetermined-rate mortgage?

Once you register for a fixed-speed financial, you and your financial try agreeing your interest rate commonly become locked in’ having a conformed period of time – constantly ranging from one to and you will 5 years. Some loan providers offer repaired costs up to eight or even ten years.

It means the interest rate do not change inside repaired-title – youre safe and your month-to-month costs are still an identical. This may bring a debtor a feeling of cover Idaho personal loans and confidence because they can budget consequently.

Foot requirements from: an effective $eight hundred,000 amount borrowed, adjustable, repaired, dominating and you will focus (P&I) repayments. All of the circumstances which have a relationship to a product or service provider’s website have a commercial selling dating ranging from us that team. These things can happen conspicuously and you will earliest inside search dining tables regardless of the properties and may also become issues marked due to the fact marketed, appeared otherwise paid. The hyperlink in order to a product or service provider’s website can help you discover more or submit an application for the product. From the de-searching for Tell you on line partners merely a lot more non-commercialised affairs can be demonstrated and you may lso are-arranged at the top of this new dining table. For additional info on exactly how we chose such Sponsored, Featured and you can Promoted circumstances, the products we evaluate, exactly how we benefit, and other important info regarding the all of our provider, delight view here.

Monthly repayment figures are quotes merely, exclude charge and so are according to research by the reported rates to possess an excellent 30 year identity and for the amount borrowed inserted. Real money is dependent on your own personal things and you may interest change. For Attention only finance the fresh month-to-month installment shape enforce just for the eye merely months. After the appeal just period, your dominating and appeal costs might be greater than this type of repayments. To own Fixed rate financing new monthly installment is dependent on mortgage loan you to applies having a first period only and will transform when the notice rates reverts to your appropriate varying price.

This new Review rates lies in a guaranteed loan amount away from $150,000 financing more than twenty five years. WARNING: This type of comparison pricing apply in order to the brand new analogy otherwise advice offered. Other number and words will result in various other research cost. Will cost you like redraw costs otherwise early installment charge including will cost you offers such commission waivers, commonly as part of the assessment rates but can influence the brand new price of brand new loanparison rates are not computed to have rotating credit products. Pricing best since . Glance at disclaimer.