And make sure to see utilized autos. They are able to either render cheaper. Just be sure that in the event that you loans an effective used car, you should never do so as a consequence of brief self-financed used car people. They’re able to charge extreme rates.

When you are unable to in fact lay a price tag about what your get of a college degree, you will find unignorable research that you’re rather better off financially having a college degree. Interest levels to the federal student fund are very reasonable. Therefore once more, you have made one thing useful within a low interest rate.

Given that a side notice, certain address=”_blank”>state and private fund might have major constraints with regards to installment, price reductions and forgiveness, so they are able usually get into this new bad obligations category.

The greater brand new Annual percentage rate, the higher this new amount of cash you may be delivering in order to their bank per month

As well as the base of the bunch is credit debt. Personal credit card debt boasts large notice, always up to 15% so you can 17% and generally pays for points that keep no intrinsic worth (eating, movie entry, alcohol, footwear…). It will make little monetary feel to carry credit debt. Avoid holding credit card debt when you can.

When you find yourself the financial institution, a premier Annual percentage rate is great, as you are the only getting the focus

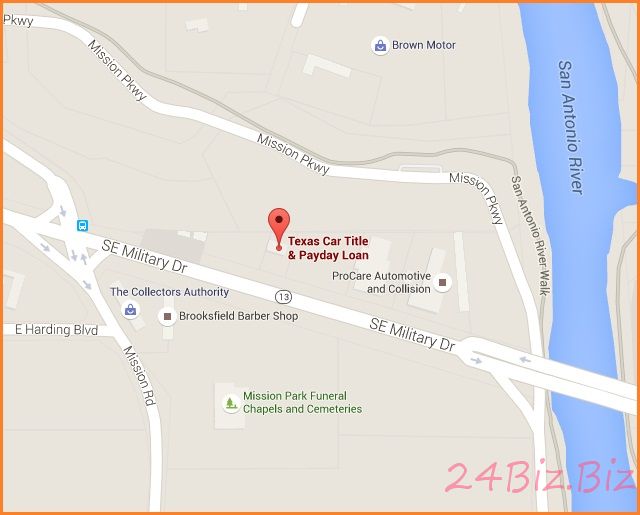

As well as the bottom of the beds base try pay check loan providers. It fees higher attention and you can fees, as well as their subscribers get caught for the never ending loops of brief-term loans. Sit much, at a distance from all of these sorts of funds.

What’s an apr? For some people the definition of Apr can posting a-shiver off the spines… What’s thus frightening? Apr is short for Annual percentage rate, and you may signifies the expense of attention and you will costs charged of the a beneficial financial on the an outstanding loan. If you owe much on the charge card, Apr is really a scary situation.

Different types of loans are certain to get different amounts of Apr. Basically, new riskier the mortgage, the greater the latest Apr. So if you provides a poor credit rating, lenders commonly ask you for higher cost while they consider your highest exposure.

Lower rates apply at finance that will be secure, or has actually property connected with all of them. Very car loans or mortgage loans usually have reduced APRs, as if some thing go bad, your own bank can invariably take back your residence or automobile. But consumer debt, including credit debt, is a lot much harder to gather when the some thing lose their freshness, while there is zero resource linked to the loan. These types of funds keeps large APRs.

But Annual percentage rate can be your buddy too. Bring your checking account such as for instance. This is certainly a basically a loan you create for the lender. Then they take your put and you can give your bank account off to anybody else. Because of it correct, your own financial will pay your focus, or an apr. Unfortuitously, currently in the long run, as interest levels are incredibly reduced, the brand new Annual percentage rate your bank gives you loans Storrs is very lower.

One thing to consider is an activity called an enthusiastic APY, or Annual Percentage Produce. An APY takes the power of compounding into account. Into the bank accounts, compounding happens when you have made desire into the desire you’ve currently earnedpounding is the fuel on what finance runs. So if you score an effective 5% Apr, that’s provided to your monthly, you can aquire compounding for the attention your already gained, throwing your own 5% Apr so you can an actual 5.11% APY acquired. But end up being cautioned. If for example the lender quotes your a keen APY on the bank account, they are actually discussing the fresh compounded come back. The true interest they’ll leave you per month will be determined by using the down Apr! Sneaky!!