A homes financing getting investment property is an ideal short-name option for a home buyers, plus Ohio title loan near me solitary-relatives house, industrial tons, or major team areas. Learn how productive financing selection out of Texas Gulf of mexico Bank may help fund the next step of the investment property, if or not getting construction otherwise renovation. A homes financing are used for an abundance of strategies, dependent on your lenders criteria and terms of arrangement. Below are a few ways by which to make use of an.

An informed Build Loan lenders out-of.

A homes-only financing, also known as a beneficial “two-close” financing, was repaid whenever strengthening is finished. Unless you enjoys good dollars to settle the borrowed funds, you’ll need to search for a traditional. New Structure Finance to possess Ground-Right up Systems Financing Terms Funds of $500k so you can $5M several-24 Day Name Appeal Only Spec invention desired Redevelopment, sales and condo financing and let Flexible launch costs into the multi-asset tactics Appeal Reserves shall be manufactured in Across the country Impact. Construction fund immediately convert to an arm (Variable Price Financial) at the conclusion of the development period Singular loan closing, saving you closing costs and stress Resource available for one to otherwise two-household members holder-filled belongings, 2nd property or vacation land Incorporate Now or call a mortgage Specialist within 800-527-1017 Residential property Fund.

Mortgage Enjoys Prosperity Lender also provides designed home structure money to order, redesign, otherwise re-finance which have competitive cost and something-day closingpetitive interest levels That-go out closure conserves cash on settlement costs The choice in order to move the loan for the a permanent domestic financial or framework only Fill in A loan Inquiry Now!. However, the rules are a little stricter for an investment property financing than for a home loan on the primary family. For instance, your most likely need fifteen-20% down instead of 3-5%. Plus credit rating. Money spent financing are used for the acquisition off next house and financing properties, in addition to you to definitely- to four-equipment land and you will travel qualities. You.S. Bank offers numerous investment property loans to complement nearly all the you prefer.

Money spent Loans – Qualification, Masters & Incorporate.

Its structure loan dimensions minimal is $125,000. Interest levels change in accordance with the field, but Nationwide’s price range is actually step one% to 1.25% more than. twenty four hours ago Developer Bizzi & Couples provides secured $313M to finance the final continue of framework on the the 273-product luxury condo tower inside the Manhattan’s Economic District. Individual equity organization Northwind.

New Structure Financing – LendingOne- Head Personal Real.

Wednesday, EST. U.S. structure spending abruptly decrease when you look at the ily homebuilding continued to slump amid large mortgage costs. The Trade Service said Wednesday construction using dropped 0.4% in December. Economists polled of the Reuters had forecast design paying. You can get a houses mortgage to possess a residential property if assembling your project preparations and you will funds see appointed financial standards. In lieu of particular home loans, there is absolutely no techniques stating that a casing financing should be applied to a first household. Build funds might be a great selection for resource money spent for the majority explanations.

Make so you’re able to Book – Framework Financial support to own Capital Leasing Characteristics.

Ideal California First otherwise Funding Crushed Up Design Funds available now. This new software accessible to maximize your leverage and you will get back!.

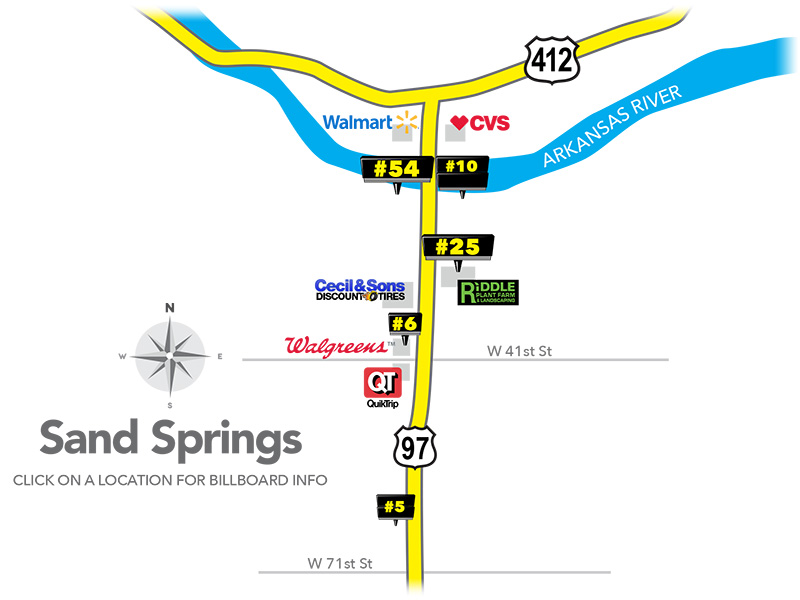

Through providing One-stop Hunting plus considerably simplifying the construction lending processes, it’s no wonder you to definitely a massive most of Vital Structure users like Sandy Springs to assist them finance their custom home!

Blanket Design Financing:

The new Blanket Construction Loan system lets a consumer the flexibility of resource up to 100% of your rates to build a custom-built home. The building mortgage is secure of the both existing family, plus the household significantly less than framework.