If you find yourself the actions is processed, utilize this time to manage boosting your credit rating. So it involves settling all expense on time and you will refraining off using up any extra obligations. A top credit score can make you more desirable in order to prospective lenders and may also make it easier to safe a reduced financial interest. Within this action, you could potentially check your credit file having mistakes, settle one a great expense, and create a reputation responsible credit need.

Step 5: Get financial preapproval

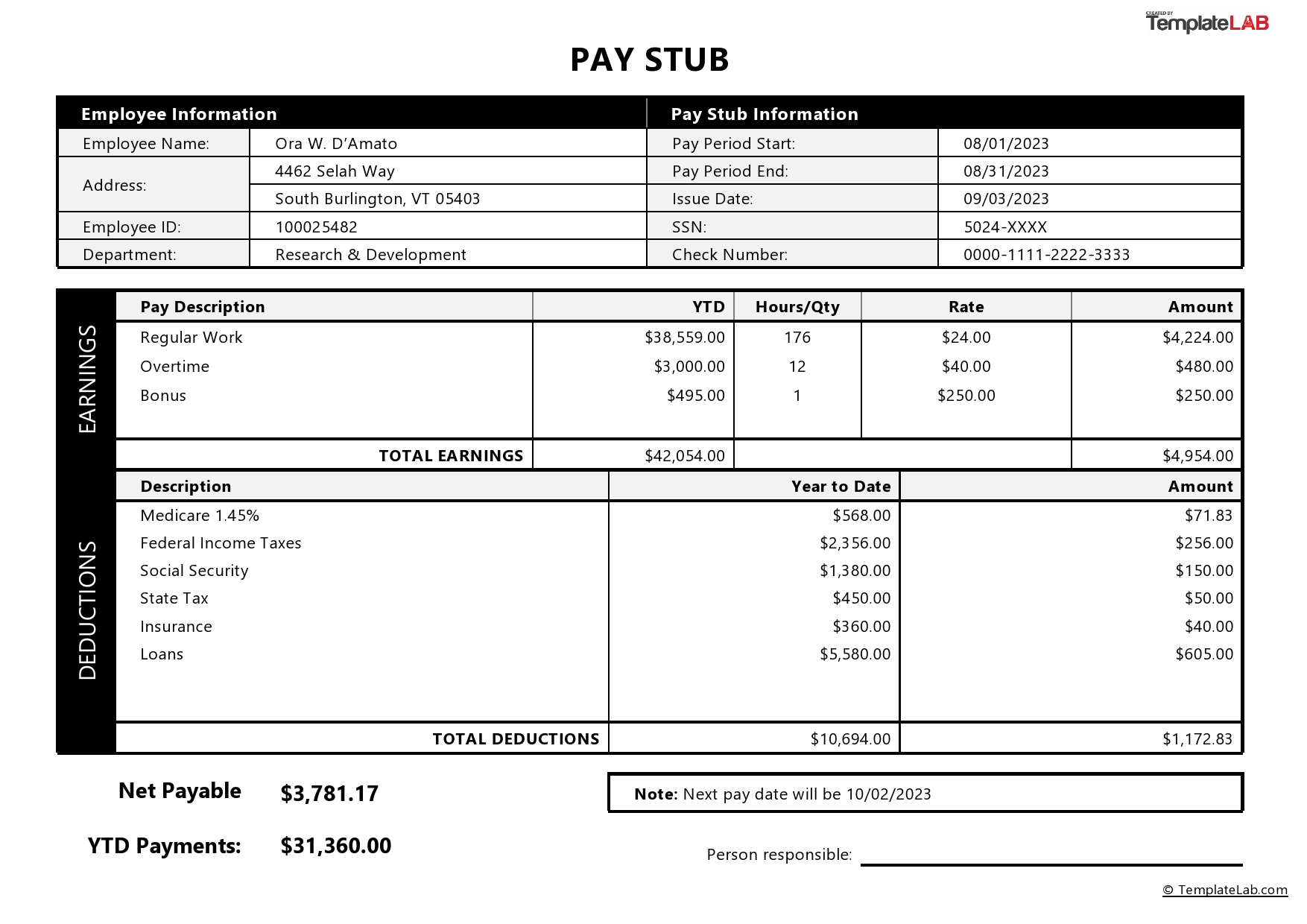

Once you’ve gotten court recognition and done your creditworthiness, it is the right time to find preapproval having a home loan. This requires providing a potential lender that have financial guidance, like your money, discounts, and you can investment.

The lending company will likely then make you a page claiming how much cash these include willing to provide your. Which preapproval letter can present you with a clearer notion of just what land you really can afford and certainly will give you more desirable in order to vendors.

Along with your preapproval page, initiate wanting your house! Make sure to factor in the costs regarding homeownership-instance assets fees, homeowners insurance, and you will repair-beyond just the cost. Think about your upcoming need too.

Once you find the right match, make a deal. In the event your seller accepts, you can easily transfer to the fresh new closure procedure, which has signing your own financial and you may completing called for papers for selecting property once Chapter 13.

Action 7: Romantic on the new house

After every one of the files is actually finalized and home loan are signed, you might intimate in your brand new home. This is actually the finally part of our home purchasing procedure and you can marks the start of their journey while the a citizen. Celebrate which high achievement!

Purchasing a home during Part 13 case of bankruptcy means careful believed, perseverance, and the correct information. But with an obvious knowledge of the procedure and you will an union so you’re able to economic obligations bad credit personal loans Minnesota, its certainly attainable.

Suggestions to be eligible for a mortgage that have Section 13 case of bankruptcy

Merely conference brand new a dozen-times significance of an authorities loan will not guarantee you’ll be considered. However, here are some ideas to increase your odds of financial recognition shortly after a part thirteen bankruptcy filing:

Of trying buying property whilst in Section 13 personal bankruptcy, hiring a bankruptcy proceeding lawyer can be hugely of use. An attorney which have personal bankruptcy experience could possibly offer invaluable suggestions, help you in navigating the difficult court process, that assist you have made judge acceptance.

In order to make sure all required papers is performed precisely and filed on time, their attorneys can also communicate with the bankruptcy proceeding trustee. They could handle your case from inside the legal and help you prepare your action getting judge recognition.

A case of bankruptcy attorneys may provide advice on precisely how to carry out their bankruptcy proceeding circumstances, such to make consistent money so you’re able to financial institutions, adhering to a spending budget, and getting ready for a future domestic purchase. At exactly the same time, they can offer information restoring your own borrowing from the bank and you may get yourself ready for a mortgage application.

FAQ: To invest in a home during Part 13 bankruptcy

Yes, you can offer a property whilst in Chapter thirteen bankruptcy. not, the method comes to getting approval in the case of bankruptcy trustee supervising your own circumstances. The brand new trustee often comment the brand new terms of the new income to make sure its on best interest of one’s creditors. While you are facing foreclosure, selling your property should be a feasible option to prevent they and you may probably protect the security, dependent on your exception limits.

Sure, you are doing you prefer recognition from your own bankruptcy trustee to buy an effective household whilst in Section thirteen. New trustee must make sure the house get will not negatively apply at your capability and then make their Chapter 13 bundle payments. It’s advisable to see your personal bankruptcy attorney prior to one significant economic conclusion during your bankruptcy circumstances.