Obtaining a mortgage is going to be just as overwhelming because it try enjoyable. Involving the papers and you will conferences, you really have probably find words one another common and you can overseas.

Understanding the mortgage procedure is a must for making a sound economic decision – and it every starts with putting on a master of home words. This new terms collateral and you may mortgage are often put alongside one another regarding the path to homeownership, but gripping its differences is key in order to finding out how loan providers consider applications.

The following is everything you need to discover equity and you will mortgage, off how they disagree and eventually come together within the borrowed funds techniques.

Security against. home loan

Guarantee and you can home loan, if you’re utilized in equivalent perspective, commonly interchangeable terms. Centered on Experian, throughout the simplest words, guarantee is actually a secured item. For large fund, loan providers require some kind of a safety net in the case the brand new borrower struggles to create a fees or completely non-payments. Should your borrower will get struggling to and come up with costs, the lending company normally grab the brand new collateral and also make upwards due to their monetary loss.

A mortgage, on the other hand, try financing particular to help you casing where in fact the a home was the newest guarantee. When taking out a home loan, if it is regarding a professional bank or private payday loans Notasulga financial, one aspect they’ll always need to know the worth of your house you are to find (the fresh new collateral). This helps them know if the financial support is just too high-risk. Most scarcely commonly a lender accept home financing bigger than the latest property value this new guarantee.

Collateral is just one essential little bit of what lenders try looking when comparing the risk of a mortgage – and ultimately if they want to deal with or reject financing application.

Just how do lenders determine security?

While lenders focus on borrowing, they are usually not the power to the home prices. To find the correct monetary value of one’s guarantee having a financial, most lenders commonly rely on a specialist appraiser, considering Investopedia. These real estate professionals should be able to consider a number out-of products towards property to determine the worthy of.

Throughout the a typical appraisal, a real estate agent takes an impartial check around this new house. They check prominent facets such as the floors plan, devices and you may square footage on top quality and you may aesthetic. They will including evaluate market trend in addition to concept and rates regarding comparable homes locally so you’re able to estimate simply how much it may be ended up selling having in the industry. They are going to pass its appraisal onto the loan providers to aid them make choice.

Certain lenders will additionally wish to know just how much house is attempting to sell to have throughout the geographic area and previous tax examination to acquire a full picture of the property value.

The 3 C’s out of a mortgage application

Needless to say, collateral is just one section of a home loan. When you find yourself lenders would like to understand property value your house you happen to be to buy, there are other affairs might to consider when choosing exactly who to help you lend in order to.

International Financing Category made mortgages as facile as it is possible, and you can part of that’s permitting consumers understand what lenders is trying to find. When trying to get a home loan, recall the 3 C’s:

Credit – Your credit score is actually first thing lenders commonly assess whenever deciding your own eligibility for a loan. It does color a picture of the prior borrowing from the bank and you can commission decisions to greatly help loan providers know how your manage loans of course you’re a reputable borrower.

Capacity – The capacity is the capacity to help make your month-to-month mortgage money. Loan providers can look at a few key elements – like your loans-to-income proportion – so you’re able to compute this element. They will certainly would also like to be sure you have got a steady money.

Exactly how collateral matches within Triple C Make sure

As you can plainly see, guarantee are a primary part of home financing, but isn’t the simply basis loan providers discover whenever reviewing a loan application.

We personal rapidly and on time as the all of our techniques is different than most loan providers, definition reduced shocks. Although many loan providers take over thirty days otherwise longer to shut, we could achieve the same in as little as 14 days. That is because we know the loan processes inside-out and you will show our knowledge having individuals to allow them to to prepare getting the mortgage before they incorporate.

We provide numerous innovative products, strength because of the cutting-edge technology. This will help to united states look at sector fashion and get the borrowed funds terms which can be extremely favorable for all involved.

I’ve lenders throughout the country that happen to be experts in your regional sector. They arrive to fulfill although not and wherever are most convenient for your requirements – whether it’s through current email address, on the cell phone if you don’t nearby cafe. They could answr fully your issues and you will take you step-by-step through the borrowed funds techniques so you has a trusted friend in the process, just financing officer.

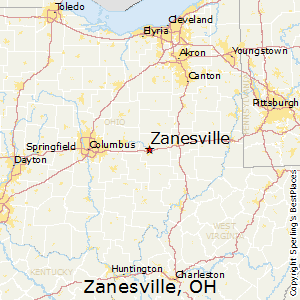

Considering your location lets loan providers to be adjusted to the present condition of industry and you will regional areas of expertise. This makes understanding the collateral part of the borrowed funds finest getting people with it.

Have it Mortgage brokers is actually punctual, painless and simple

If you’ve discover a house you adore otherwise was not as much as a good day crisis, envision searching your following mortgage having Contain it Lenders. I pleasure our selves into the our Multiple C Make certain to help you improve new loan process and also your moved during the easily.

All of our local loan providers focus on your unique industry and generally are simply a phone call otherwise email away to respond to people and most of the inquiries you have. Purchasing a unique home doesn’t need to getting overwhelming towards correct help. E mail us right now to find out more about the lending procedure and you may begin to make buying your residence a reality.