For some reason, Virtual assistant financing have seen the newest unjust and you will baseless reputation of getting a fuss–the application form techniques was difficult, they take more time to close than just traditional money, as well as the Virtual assistant is actually a mess.

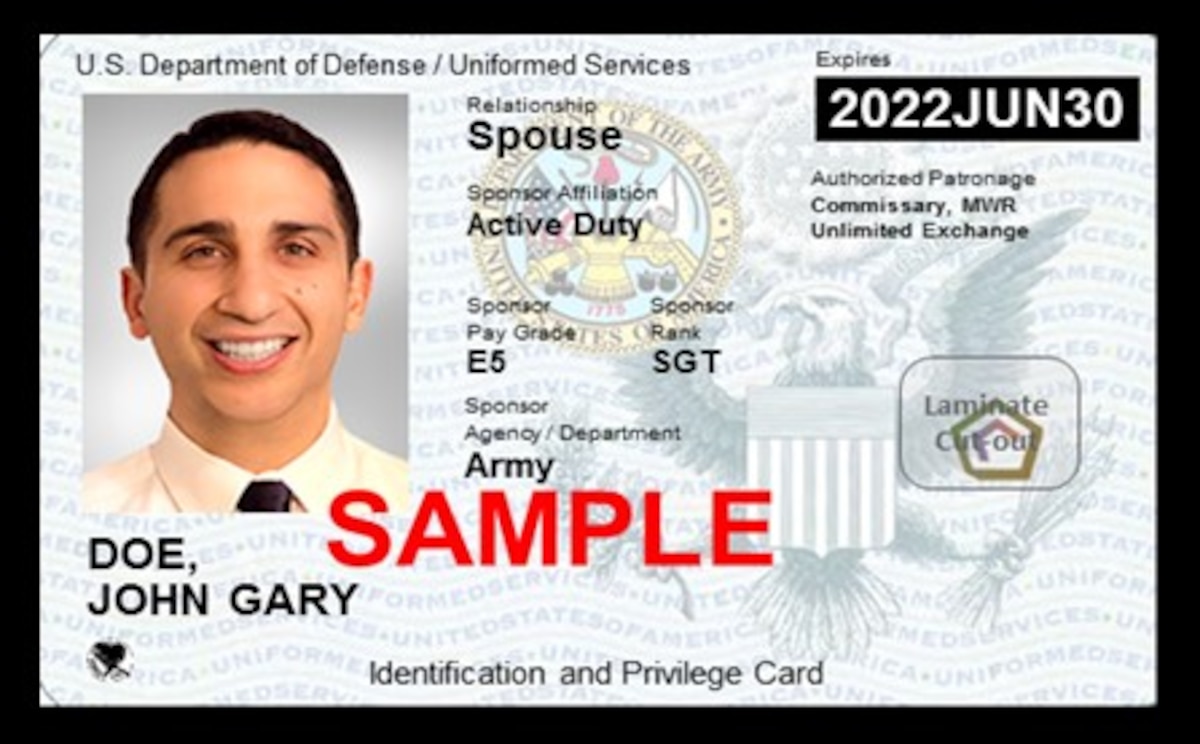

In order to meet the requirements with the Virtual assistant, you prefer what exactly is called a certificate out-of Qualifications otherwise COE. Of a lot loan providers will help your from inside the determining the eligibility and receiving your own COE in just a few moments. This is beneficial due to the fact eligibility requirements can be somewhat difficult and you may are different centered on your own status as a vet or effective responsibility servicemember, part from solution, and if you’re the fresh new thriving mate off a veterinarian. Into the oversimplified terms, exactly what it comes down to are amount of services, and type of launch–dishonorable discharges is actually disqualifying.

Another Va financing individual i questioned, Vic A beneficial., a 50 year old former Army Biggest said that the procedure is pretty quick. You just need to get DD-214, that is the discharge means. Following its such as for example applying for any kind of mortgage. Check the Qualifications webpage of the Virtual assistant website to own an entire rundown of eligibility requirements when you have questions.

Ashley, the air Force Reservist i talked so you’re able to, bought her basic home using an effective Va loan inside a small more a month

Because Va loans don’t need a downpayment and have now even more easy credit and you can personal debt-to-income standards, the fresh difficulties so you can homeownership try below he’s having a good old-fashioned loan. The quintessential high thing pros deal with when trying to get an excellent Virtual assistant financing try a position records, particularly when they have recently leftover this service membership. Lenders usually choose a lot of time, unbroken a position tenures that demonstrate a borrower’s capacity to consistently generate monthly premiums. Although not, a job conditions vary from lender so you can financial, and you will money aside from normal a https://availableloan.net/personal-loans-oh/columbus/ job was taken into consideration.

Just because you have not spent a good e office or business cannot imply you really need to give up on your ideal from possessing your own residence; it really means you may need to comparison shop a small to own a loan provider.

The fresh new profile Virtual assistant finance have for taking lengthened to close than almost every other mortgage sizes is even false. Since there is a certain degree of red tape in it (we’ll reach that in a few minutes), Va loans personal, typically, during the fewer weeks than simply antique otherwise FHA funds. Regarding earliest call so you can the woman lender to closed price and you will techniques available, it took the lady a shorter time than just Very first Degree–no more than the newest 46 go out average having a traditional financing, considering Federal national mortgage association.

It is true that you ought to qualify for a great Virtual assistant loan each other for the bank and with the Institution of Pros Circumstances in itself, in lieu of having a traditional mortgage

As with other kinds of mortgages, your own earnings and you may financial history is carefully checked-out when making an application for an effective Virtual assistant mortgage. And you will, like with almost every other money, delivering all your valuable papers planned ahead of time commonly facilitate the newest overall procedure. Really, the actual only real almost every other biggest difference in Va and you will traditional financing–one to red-tape i mentioned–is the fact anywhere between finalizing a purchase agreement and you will closing to your a good possessions, you will need to possess a certified professional manage a beneficial Virtual assistant appraisal to guarantee the property is selling for the real really worth and suits the newest VA’s lowest possessions conditions.

These MPRs is a list from standards particularly entry to and you can standard servicing, to ascertain that the house is hygienic and you will fit for habitation. Even though the yardstick for just what comprises fitness is a bit vague, the newest Va, usually, doesn’t be sure money to possess fixer-uppers. If you have the center seriously interested in fixing a struggling assets, you’re better off going the typical channel.