According to Va loan assistance, eligible consumers are able to use a beneficial Va loan purchasing belongings and you can property to one another, but not homes in itself.

You can utilize the Virtual assistant loan to shop for home really if you also have plans to create for the property immediately.

- You should focus on an effective Va-acknowledged builder having valid Va character.

- You can not build a house with well over four units. Each unit have to have its very own energy relationships, therefore need to take one of many units since your first household.

- Your residence have to be constructed on and you will affixed so you’re able to a long-term basis.

- Your home need to comply with the fresh VA’s lowest assets standards. It will as well as fulfill government and you will regional building criteria.

- The residential property can not be into the a ton or appears region, near a dump, or in an area at risk of major disasters such as for example landslides or earthquakes.

Sure, you need to use the Va financing to purchase residential property; yet not, there are essential standards and you can constraints to be familiar with:

- Construction Purpose: The key purpose of having fun with an excellent Virtual assistant mortgage to purchase residential property is actually for strengthening a house thereon property. Va financing are not generally speaking used in vacant residential property commands instead of the intention of design a property within this a good schedule.

- Eligibility: To utilize a Va loan to invest in homes and build a beneficial family, you need to meet up with the qualification requirements to own a good Virtual assistant mortgage. That it usually pertains http://www.paydayloancolorado.net/blue-sky to getting an eligible veteran, active-responsibility service representative, person in the fresh new Federal Protect otherwise Supplies, or an enduring spouse away from a service member exactly who died for the the fresh new collection of duty otherwise because of an assistance-linked disability.

- Entitlement: The Virtual assistant mortgage entitlement restrictions the total amount of the loan you can receive without a down payment. It limit may vary according to your local area and you may whether you have tried your own Va loan entitlement just before.

- Construction Agreements: If you are using a good Virtual assistant financing to possess belongings and construction, attempt to possess accepted construction preparations and obtain necessary it permits. The new Virtual assistant bank should remark and you may approve such preparations.

Its important to manage a beneficial Va-recognized financial who is experienced with Va residential property and construction fund, just like the techniques could be more complex than a vintage Virtual assistant home loan.

Region Lending can also be make suggestions from the requirements and make certain one to your meet all of the expected criteria for using a beneficial Virtual assistant financing to find home and build a property.

End & Wrap-Upwards

To close out, to invest in homes that have a good Virtual assistant loan is really you can easily, but it includes specific standards and you may limits designed to be certain that that primary mission is to try to make property on the property.

Experts and you may qualified anyone can use a great Virtual assistant financing to order one another land and you may assets to one another, given he’s got acknowledged framework arrangements, intend to create to your homes quickly, and you will see certain qualifications conditions.

When you find yourself such conditions may sound strict, he could be set up to protect brand new purpose out-of Va financing and make certain that they are used for their intended purpose of permitting experts safe a house.

In order to browse the reasons away from Virtual assistant belongings and construction money, it is very important so you can work together which have an informed Virtual assistant-recognized bank like Area Credit, who can show you through the techniques that assist your fulfill all the needed standards for buying home and you may strengthening your dream house with a good Virtual assistant financing.

When you need to pick or refinance your property for cheap, to provide Va property fund, you can buy in contact with you Here.

Concerning the Creator

He could be among the earth’s top experts in seasoned masters, that have helped an incredible number of pros secure their financial future since the 2013. Brian ‘s the originator Va Claims Insider, a degree-created Sessions & Consulting organization whose goal is to try to educate and you may enable veterans to have the Virtual assistant impairment benefits they have made for their honorable service. A former active-obligation heavens force administrator, Brian implemented in order to Afghanistan to get Operation Enduring Independence. They are a significant graduate regarding handling of the united states Air Force Academy and received his MBA because a national Award Scholar on the Spears College out of Organization at the Oklahoma County College or university.

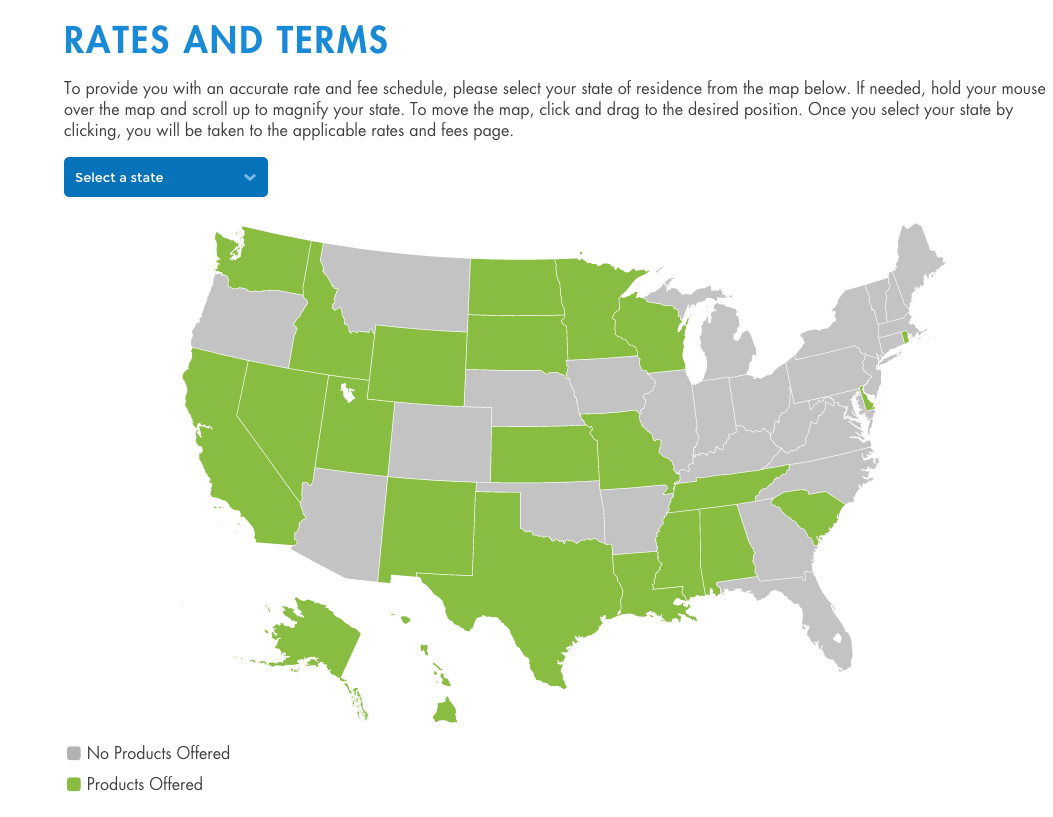

Given that an army seasoned, I have managed to make it my personal life’s mission to help people real time pleased and wealthier existence. Section Lending will bring so it purpose alive. We think inside stability, sincerity, and you will transparency, this is exactly why you will notice all of our cost close to all of our web site. You can find lower pricing and you will no financing costs, so you can buy your perfect domestic for less. The latest offers are passed on to you – the way it can be.