When selecting a home, really married people sign up for the loan together. However, there are times when a beneficial homebuyer may want to get a traditional financing in place of the spouse.

Quite often, that isn’t a challenge. Nevertheless same cannot be said in the other types of lenders, and additionally regulators-backed mortgages provided by new FHA, Va, and USDA. Eventually, certain factors count on new marital assets rules on your own county.

Marital Possessions Laws Are very different because of the County

Not totally all says consider relationship possessions, that’s, possessions received throughout your age. Though some might have book legislation regarding marital assets, capable be split up into one of two kinds: society property says and you may common-law possessions claims.

Antique Money inside the People Property States

In the a residential area property county, every assets attained by the often companion are seen as the equally common assets out-of one another partners.

not, getting antique loans, your own wife or husband’s obligations does not need to meet the requirements in financial trouble-to-income percentages if they are instead of the loan software.

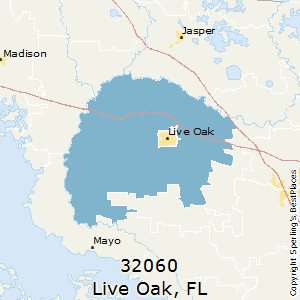

On top of that, the usa regions off Puerto Rico and Guam observe community assets rules. Alaska, Kentucky, Fl, and Tennessee enable it to be hitched individuals to enter into a residential district possessions agreement. Although not, it just has an effect on your property pick if one another partners have officially opted into the.

Government-Recognized Funds inside the Neighborhood Property Says

Government-recognized mortgage loans, which includes FHA, Va, and you can USDA fund, follow a somewhat various other method in the community assets claims. Yes, you could sign up for home financing rather than your lady, nevertheless these loan providers continue to be necessary to think about your payday loans Madison Center partner’s existing bills when calculating the debt-to-money ratio (DTI).

That is because community property legislation work each other indicates: assets was mutual just as between each other people, but very is the responsibility to own financial obligation.

Antique and you can Bodies Financing in accordance Legislation Possessions Says

Aside from the nine community property states, the remainder All of us belongs to common-law possessions legislation. Not as much as common-law, possessions (and you can expense) obtained by the you to definitely companion fall into all of them entirely. There’s no expectation out of shared possession or responsibility.

In every common law property says (as well as optional says the spot where the marriage doesn’t have authoritative people assets agreement), you could potentially sign up for a normal financing without your wife. Just your credit history, money, and debt obligations would be noticed because of the loan providers, and you also do not need to are your ex towards label to your assets.

An identical pertains to mortgage loans supported by new FHA, Va, and you can USDA, which do not are their partner’s debt burden whenever calculating DTI in common laws says.

Note: You still have the choice to provide your wife to the property’s name in common laws states, even if they aren’t into the mortgage. But unlike inside venues one to see community assets, youre not as much as zero responsibility so you can most of the time.

Reasons to Sign up for a normal Financing In the place of Your wife

There clearly was usually a monetary inspiration when you to definitely companion enforce for a loan in place of its companion. Seem to, the reason being you to spouse provides a much better credit score as compared to most other and certainly will qualify for a traditional financing having keep costs down than when they was in fact using jointly.

They do not have verifiable or adequate money records. This could apply at individuals up against work losses or furlough otherwise even so you’re able to a self-operating business person just who does not have any the required 2 years off taxation statements from their has just become organization.

You might be utilizing a taxation or property thought means, that makes it best for take a loan on your own label just.

You’re to purchase an investment property that have a higher level away from chance, and you must maximum borrowing effects to just one partner inside case out of standard.

Your spouse has a judgment up against all of them otherwise intentions to file to own personal bankruptcy, while must manage your home out-of claims by the creditors.

Mortgage Costs When One Mate Features a decreased Credit history

One of the most well-known reasons for having someone to submit an application for a loan instead their spouse is due to less than perfect credit. A low credit history normally drive right up financial costs and you will payments, particularly for old-fashioned funds.

That’s because in terms of interest levels and you may costs, lenders base their figures into the co-debtor into the lower credit rating.

Extremely conventional money features loan-top rates customizations (LLPAs) that differ according to your credit score. This will help to lenders to compensate to have large-risk purchases. The most effective conditions was LLPA waivers getting earliest-big date homebuyers and you may low-income programs for example HomeReady and you will Household You’ll be able to.

For some antique money, however, you’ll likely see significant deals applying by yourself unlike which have good companion that a reduced credit score.