Increasing home prices are making homeownership reduced reasonable to possess American users, specifically young and you may earliest-time homeowners, with almost 39 % from Gen Z hopefuls mentioning preserving getting an advance payment as his or her better challenge. step one If you find yourself off costs are often the focus out-of surveys and conversations, its character shouldn’t obscure the important demands posed by the closure will cost you. Settlement costs shall be ample-probably amounting so you can a hefty part of the price-and can feel as often out of a barrier in order to homeownership once the down payments.

Deposit conditions promote an obvious results of value questions and you may macroeconomic pushes such as highest cost, reasonable stocks, and you will high rates. Closing costs, not, is actually faster clear however, no less impactful. The blend of fees-appraisals, ton insurance rates, label insurance policies, and much more-can make a confusing test direction for possible people, especially first-day buyers, it is therefore hard to save yourself of these will cost you otherwise create told alternatives in terms of them. The current individuals are even less alert to how changing field land quietly shapes the borrowed funds costs they deal with. This new previous retreat of highest banking institutions from the home loan markets have supported to intensify brand new constant tip into the nonbanks who began 61.6 per cent of all of the closed-avoid basic-lien single-family home purchase money in the 2022. dos

New diminishing exposure of antique banking institutions on financial origination sector potentially set the latest phase getting a much better concentration of nonbank credit. Decreased battle can also be consequently trigger increases into the upfront charge. step 3 Which growing landscape you will definitely slim borrowers’ choice and you can personally determine the fresh new costs it bear, putting some number of a lender a serious choice having high monetary implications. While many conversations on the homeownership barriers run circumstances for example race or property likewise have, we believe that the role off bank selection including may be worth attract, echoing an ever-increasing chorus away from scientists that raised similar questions. 4 So it opinion falls out light regarding how some other lending habits connect with closing costs and also the the amount that these types of will cost you are different all over racial organizations. Furthermore, i look into how borrowers’ financial literacy and you can needs influence choices about lenders and you may, ultimately, will cost you toward borrower.

I examined social Home loan Disclosure Operate (HMDA) studies out-of 2021 and you will 2022. In order to categorize lenders, i blended the brand new HMDA research in order to a lender group document-the newest Avery File-and categorized toward around three categories: Nonbanks, Banks/Credit Unions (combined because the banks for ease), and you will Representative/Correspondent Lenders (brokers). 5 We worried about step 3.nine million 29-seasons fixed, compliant get loans getting solitary-household members number one property. I excluded loans that have unusual possess eg contrary mortgages otherwise non-amortizing features. 6

I concerned about get financing for some factors. Refinancings will include moving settlement costs to your financed amount borrowed, and then make percentage contrasting probably unsound. Particular low-depository lenders, such as some fintech organizations, primarily target the brand new refinancing business section, instance nonprime, low-earnings, and you can fraction organizations. eight Comparing across the lender types from the buy industry provides a a whole lot more well-balanced view of competitive costs actions across the some other loan providers. 8

However, new increased studies can always give beneficial understanding into feeling off race and you will financial form of towards closing costs

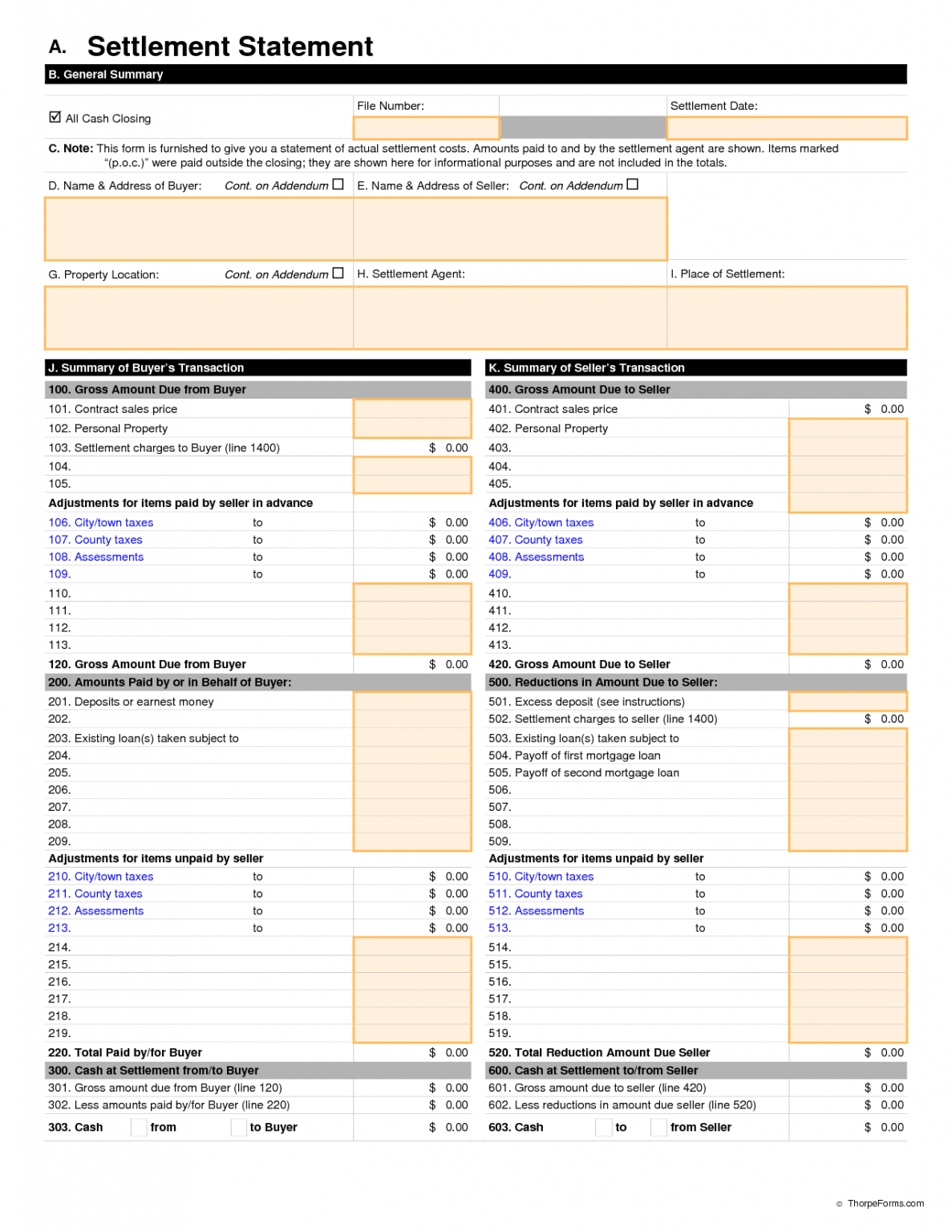

I believed settlement costs because of the summing Overall Loan Will cost you and you will Full Affairs and you may Charge. Whenever you are HMDA has actually rather improved within the capturing financial costs, limitations continue to be. Lengthened HMDA cannot take all out-of-wallet will cost you or offsetting credit received by the individuals.

Rising cost of living and a top interest rate environment still move the target beyond take of numerous ambitious homebuyers, specifically those which have lower income unable to save your self to own or afford the costs out-of a mortgage. A strict markets substances monetary pressures and you will constrains borrowers’ choice-both in terms of lenders they can consider and you may the available choices of affordably-listed items available. We used unique studies on Federal Set-aside Financial of new York’s (FRBNY) Borrowing from the bank Insecurity List so you’re able to situate new advanced net of demands contained in this regional borrowing economies. All of our study implies that debtor struggles that have settlement costs aren’t separated but rather come from loans Del Norte systemic items regarding borrowing accessibility and you can quality. I compute an ending pricing weight due to the fact ratio away from a good borrower’s earnings spent on loan costs. Brand new size features the amount to which these will set you back substance monetary strain to own consumers, especially when noticed relating to credit low self-esteem.

We mutual HMDA, Western Society Questionnaire, and you can Borrowing Insecurity datasets to examine relationships ranging from money, race, bank style of, and you will loan settlement costs

FRBNY’s Credit Low self-esteem Index was designed to scale people monetary better-getting although the contact regarding the means to access credit, a monetary investment one to supports monetary resilience. nine Beyond pinpointing borrowing from the bank assured and borrowing insecure teams, the fresh index characterizes neighborhood economy’s ability to promote accessible borrowing items to the reasonable terminology. Brand new binscatter plot portrayed for the Profile 1 suggests a definite relationship between average closure cost burden when you look at the a great census area as well as amount of borrowing low self-esteem. Consumers from inside the borrowing insecure organizations deal with disproportionately highest closing pricing burdens compared to those inside borrowing in hopes communities. Improved closure costs burdens pose extreme risk having consumers that have minimal savings and you will lowest incomes. A much bigger show cash used on settlement costs and you will off costs depletes important bucks supplies, heightening the potential for coming delinquency and additional entrenching the brand new course from borrowing low self-esteem. ten

This type of improved upfront exchangeability burdens also have impacted borrowers’ credit eligibility. We reviewed rates out-of denials to have decreased loans to shut and you may receive an identical self-confident correlation which have society borrowing from the bank insecurity. Large costs from low self-esteem coincided that have a heightened chance out-of denials due to the inability to cover down money and you may settlement costs.