- 0% deposit to have loan amounts to $step one.5M

- 5% downpayment for financing quantity to $dos.0M

- 10% down payment to own financing quantity to $dos.5M

Flexible options to reveal income

One of many standout top features of the best medical practitioner mortgages is actually flexible options for appearing being qualified income. We know that earnings provide may differ generally within the medical job, and you may the approach was created to fit these types of distinctions.

- W2 Income: You complement this category if you are working and you may salaried of the an effective health, created scientific habit, or an equivalent organization. There is absolutely no seasoning demands, for example latest changes in work or income height doesn’t feel a burden.

- Price Money: Earnings generated owing to deals, such as a physician developed so you can a hospital but not researching W2 wages, may also be qualified.

- Coming Earnings: For those who have a finalized a job package with a medical facility otherwise a reputable medical routine, along with your employment is determined to begin with inside 90 days out of the borrowed funds closing, so it earnings can be considered. Getting individuals contained in this group, which have adequate supplies to fund expenditures during the time up until the start big https://speedycashloan.net/loans/payday-loans-for-veterans date is necessary.

- Self-Functioning Income: For self-working doctors, lenders usually thought 12 months out of centered earnings, as confirmed by tax returns and you will year-to-big date finances-and-losses comments. Which acknowledges the unique financial activities of these whom work at their individual scientific techniques.

This flexible approach to earnings verification ensures that a broader diversity away from medical professionals and you can physicians can access your house money they need, highlighting the fresh new varied ways medical professionals secure their income.

So you can qualify for a doctor mortgage loan, the utmost personal debt-to-earnings (DTI) ratio is usually around forty-five%. Yet not, in case your borrower’s credit history is in the 600s unlike the fresh 700s, maximum DTI drops to around thirty six%. Significantly less than certain points, education loan personal debt can be excluded about DTI formula.

Lenders for medical professionals has actually special advice away from personal debt one to reflect the initial monetary activities commonly faced in the world.

- Highest Restrict DTI Greeting: Doctors might have large personal debt profile through its educational and you may field pathways. Therefore, the utmost DTI acceptance is usually as much as 45% (depending on credit rating), that’s a little increase in the basic 43% enforced because of the more conventional lenders. This high tolerance provides extra independence for those which have large obligations account, making it simpler so that they can qualify for a loan.

- Planning having Student loans inside Deferment: Knowing the high capital when you look at the education one to ds offer certain factors for student loans. In the event the a student loan is actually deferment for at least a dozen months at mention time, it could be excluded on the DTI formula. This exception is contingent to your lender’s reasonable commitment that borrower’s income has a tendency to raise by the end of one’s deferment months and will be sufficient for prompt cost of student loan personal debt shortly after they resumes.

These pointers are created to accommodate the fresh new monetary details of several medical professionals, specifically those early in the careers or which have big educational financial obligation.

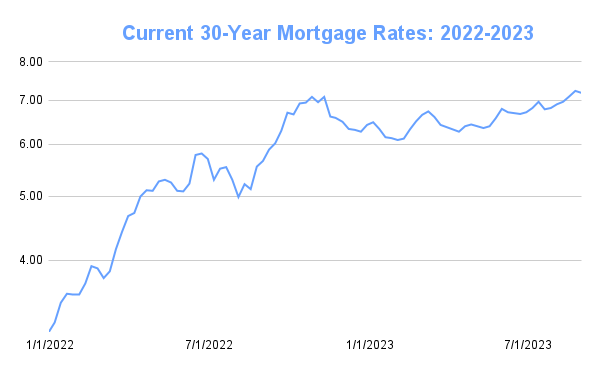

Medical practitioner financing mortgage costs create physicians be eligible for straight down financial cost?

Home loans to possess doctors will function positive doctor home loan rates that will be aggressive on the market, bringing a supplementary financial benefit to those in the profession. This type of aggressive pricing is a recognition of one’s stability and you may reliability inherent inside medical care work.

Concurrently, there can be a chance for borrowers to receive a slight loss in the mortgage price once they go for vehicle-deposit regarding a checking account opened toward financial, provided the lending company was a depository place. It incentive not simply has the benefit of then financial positives plus encourages a thorough banking relationship within doctor therefore the financial.