Well done on the decision to locate the licenses and be an effective financing administrator; you really have without a doubt arrive at the right spot!

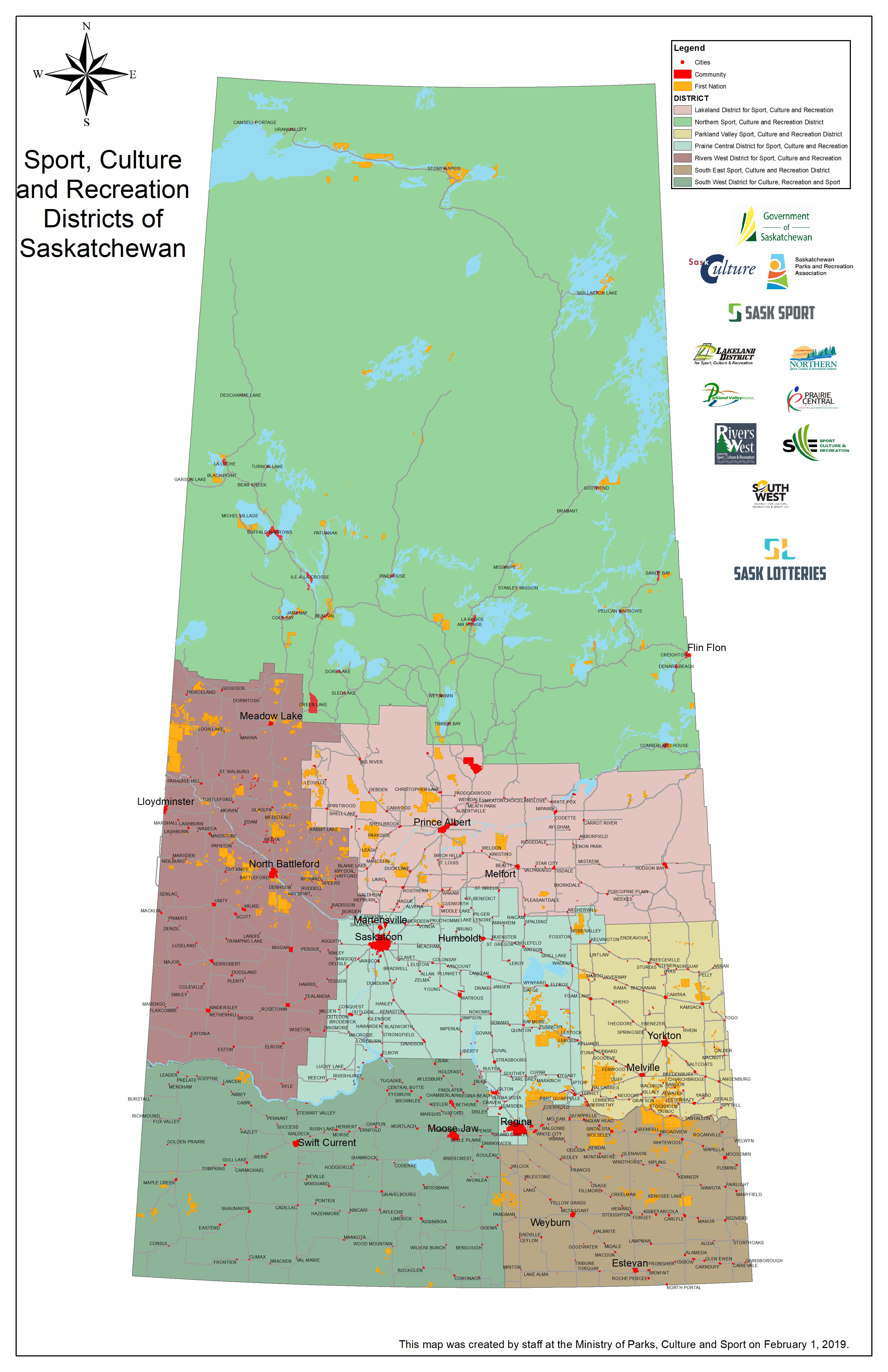

was an information middle for the home loan administrator need. Whether you are collecting information about as a loan manager, in search of NMLS recognized categories, inquiring on license standards, or finding financing manager work, we need to help make your existence simpler by the at the rear of your thanks to brand new actions. Criteria will vary because of the state, therefore delight look for your state on the map less than.

Online care about-study (CE) and you may instructor-contributed on the internet (Pre-license) courses are supplied by way of a partnership that have Cape School Inc. NMLS Provider #1400105.

Real estate loan Manager

Some people was inquiring what is the difference in a mortgage loan creator (MLO) and you will a mortgage manager? The solution, both are truly the exact same, nevertheless certified term are Home loan Creator. Most people on the market, yet not, only make reference to themselves since mortgage officials.

Loan officials gamble a key part into the society, that’s the reason the mortgage mortgage marketplace is one of many most popular certainly people looking for work today. Long lasting area of the You.S. you live in, often there is a consult getting loan officers. Individuals are usually thinking of buying brand new residential property otherwise refinance established of those, loan places Pell City assuming this occurs, mortgage loan officials are required in the act.

Home mortgage Manager Job Breakdown

The job malfunction to have a mortgage administrator are different oriented about what version of status a person is trying to get.

Instance, there are two particular loan officers: residential loan officials and you may industrial financing officers. Each other perform the exact same types of duties but to your different kinds away from qualities. A residential financing manager can assist a debtor with to shop for or refinancing a house when you find yourself a professional mortgage administrator can assist an excellent borrower during the to purchase commercial real estate (place of work structures, centers, an such like.) that’s utilized entirely to have providers purposes.

Most financing officials have employment with creditors such as for instance, financial institutions, financial businesses and you may credit unions. However some loan officers work at the employer’s area, most invest their time-out of one’s work environment promotion its qualities to help you realtors and you can possible borrowers.

- Learning potential consumers compliment of ads, meetings, telemarketing, etc.

- Helping consumers in selecting best financing software

- Compiling loan applications and you can getting expected papers requisite

- Emailing appraisers, escrow officials, mortgage underwriters, etcetera.

Mortgage Officer Criteria & Standards

The brand new Safe and you can Fair Administration for Home loan Licensing Operate off 2008 (Safe Act) dependent conditions into certification and you may/or subscription of all Home mortgage Originators (MLOs.)

Below you will find the brand new career standards must be good state-licensed mortgage loan administrator; please make use of the website links to learn more about the topic number:

- NMLS Criminal record check Fingerprints will need to be registered by way of NMLS for an enthusiastic FBI criminal record check

- NMLS Degree Achievement out-of pre-license studies

- NMLS Comparison Required to pass National and Condition components of brand new Safe MLO Try

- NMLS Credit file Candidates are certain to get a credit file tell you NMLS

If you’re considering a career as an authorized loan administrator, then you certainly most likely currently have their explanations. Yet not, we shall give you a few more explanations as so you’re able to as to the reasons this should build an excellent industry flow:

You are providing anybody achieve its desires. It may be slightly fulfilling enabling possible individuals select the fantasy house inside their finances. Youre generally leading them to the dream about homeownership by the at the rear of them from the procedure and you may training them on which it is because they is actually to acquire and you may whatever they are able.