Doubly of a lot pay day loan readers work at Walmart as compared to the following popular company, Kaiser

Payday loans are used of the people who you need currency quick, just who usually have simply no other way away from credit currency to cover an unexpected bills. The main benefit of these kind of funds is that they assist you to fulfill your own immediate obligations. The chance, however, is you was taking up financial obligation and running into future debt one to need future earnings to generally meet.

On this page, we are going to get acquainted with the use status of individuals who accept pay day fund. Create he’s work that will enable them to pay new fund in a timely fashion otherwise will they be cornering by themselves towards some debt with no earnings so you’re able to actually pay back the latest finance?

During the LendUp, we offer funds to those to pay for unanticipated expenditures otherwise whenever they need the money fast. Due to our very own many years of underwriting financing and dealing with this consumers, we all know a great deal concerning monetary background of our financing receiver.

Inside studies, we shall comment the knowledge toward work qualities regarding People in the us exactly who consider payday loans. Exactly how many individuals who consider pay day loan has actually jobs? Are they operating complete-time and where perform they work?

I found that the challenging most of payday loan recipients (81.2%) have full-time jobs. Once you range from the amount of readers that actually work region-time otherwise seem to be resigned, you to definitely makes up about more than ninety% of readers. Most commonly, payday loans recipients work with conversion process, place of work, and health care assistance. The most used manager away from LendUp users exactly who seek a payday financing are Walmart, accompanied by Kaiser, Address and Family Depot.

As part of our loan application procedure, we ask individuals to state their employment status and latest boss. For this analysis, i analyzed finance out-of 2017 so you can 2020 observe by far the most common employment standing, industries and companies. The content is out of claims in which LendUp currently operates (WI, MO, Tx, La, MS, TN, CA) including extra states in which we previously made money (IL, KS, Los angeles, MN, Okay, Or, WA, WY). Regarding the most famous companies from payday loans recipients, these records set tend to reflect the biggest companies inside our largest avenues, including Ca.

81.2% of all the payday loan readers towards LendUp has actually complete-day work, and therefore they must has actually money going to repay the expense. Commonly, people have fun with cash advance to purchase time mismatch of obtaining a cost to arrive before the paycheck happens to pay for it. For many who incorporate those who try part-time operating, resigned, or thinking-useful to people with full-time a career, you account for 96.1% from payday loan receiver. Just 1.2% of cash advance users are known as unemployed.

To start, let us look at the a career reputation of people who score pay check finance through LendUp

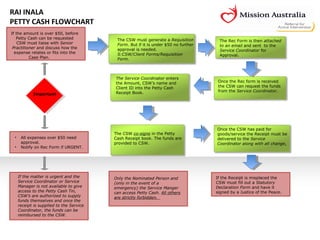

Within our app techniques, LendUp pay day loan recipients report information regarding its globe out of work. The second graph reduces mortgage users because of the business:

The most used community to possess needing a payday https://paydayloansconnecticut.com/naugatuck/ loan was sales relevant. This may were merchandising experts or sales people implementing a commission having an unpredictable shell out schedule. Next most common marketplace is some one doing work in work environment and management. Regarding note, the 3rd most commonly known group was health care related.

Finally, let’s look at the companies most abundant in payday loan receiver. As previously mentioned earlier, just remember that , this data reflects the use legs into the areas where LendUp works which together with large businesses will arrive more frequently on the below list:

Walmart, the largest employer in the usa, ‘s the matter boss away from payday loan readers due to LendUp. The list is ruled by shopping enterprises, plus medical care, knowledge, and bodies.

Within this study, we’ve got revealed the most away from pay day loan receiver try working fulltime. Even with getting a frequent money, costs arise that people do not have the family savings balance to fund. A few of these somebody work with university, healthcare facilities, in addition to areas that have offered essential services on the pandemic. Anybody get cash advance to cover immediate costs, and also for of numerous People in the us, these on the web money certainly are the just way to obtain capital readily available through the days of disaster or whenever economic needs surpass available financing.