You possess your own company and they are pleased with your prosperity congratulations! Nevertheless when it comes down time for you sign up for a mortgage, you might not getting since the excited. Due to the fact you’re not new ‘typical W-2 wage earner,’ lenders is almost certainly not given that amicable as the you’d pledge. Your loan options rapidly dwindle, particularly if your own tax returns try not to tell you very much income. If you’re able to persuade The government you do not generate much money, extremely loan providers elizabeth.

Luckily for us, which is just for conventional home loan financial support. Self-employed individuals instance your self an unusual financing. Simply put, talking about loans one to ‘think outside the box’ and don’t hold that eg rigorous requirements. Alternative loan choices let individuals like your self buy the fantasy home even if you can’t verify your earnings the conventional ways.

Exactly how Mortgage loans Work with brand new Notice-Operating

A mortgage is actually a home loan wherever you work. Loan providers all have a similar bottom line. They have to learn you really can afford the loan beyond good practical question. Conventional and you can government-recognized financing, however, have more strict conditions. You ought to prove your income the standard means, meaning that shell out stubs, W-2s, and/otherwise taxation statements. While notice-employed regardless of if, you age money as good W-dos earner. The usa tax password lets entrepreneurs to write out of a good extreme part of its money. This will be an excellent option for your own taxation responsibility however delicious when loan providers check your taxes and you may shape your income. It makes sense you to mind-employed individuals discount as numerous expenditures because they can. Who would like to shell out much more taxation than just needed? It makes an effective organization experience, nevertheless you may angle difficulty when you submit an application for a great mortgage.

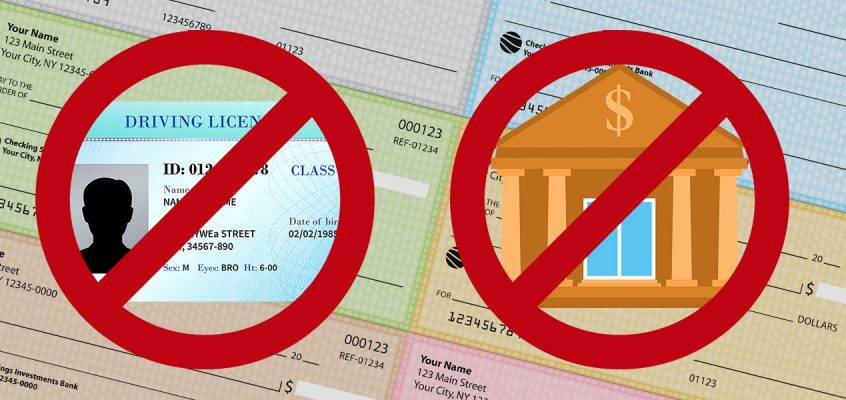

Right here is the problem. Loan providers utilize the exact same adjusted gross income you claim to the your own fees. For individuals who individual a business and you americash loans Lester, AL can discount a beneficial part of earnings, you appear ‘broke’ regardless if that’s not the scenario. Old-fashioned , FHA , USDA, and you will Va loan lenders need guarantee your income utilizing your taxation output. Should your tax statements tell you little income, do you know what? Regarding attention of lender, you make nothing money. One actually leaves your instead mortgage approval. Having the current laws and regulations, loan providers have to guarantee past a fair doubt you could afford the loan. This does not bring antique or authorities-backed lenders the ability to take on financial statements or any other money papers to show you really can afford the loan. Loan providers has actually specific debt-to-earnings rates you must meet to help you be eligible for its financing. On the other hand, you ought to meet the income verification direction. This consists of getting the tax returns to confirm the a job.

The answer to have Care about-Employed Consumers: P&L Report Loans and Financial Statement Loans

So far, it doesn’t voice guaranteeing for care about-employed borrowers, best? You’ll both features a tough time being qualified together with your ‘lower income’ due to your tax establish-offs otherwise you can easily shell out a higher rate than envisioned since the of your own chance your loan presents. If you prefer a home loan that will not discipline you and helps make it easy so you’re able to qualify once the a home-working debtor, consider obtaining an effective P&L Report Financing otherwise a bank Declaration Financing . These are higher options in order to a classic home loan while they cannot manage your tax statements, however, create most other ways of income confirmation.

Just how P&L Declaration Mortgage loans Really works

Financial consumers shopping for an effective subprime financing can apply on P&L mortgage which is one of many safest finance having thinking-operating individuals to make use of. In place of with your tax statements, you could be considered to your past a few years’ Finances & Losings statements served by your accountant. The fresh new P&L confides in us how much money you bring in and you can what you really can afford. I compare your income with the latest costs just like the said for the your credit report and your credit rating.