Low interest

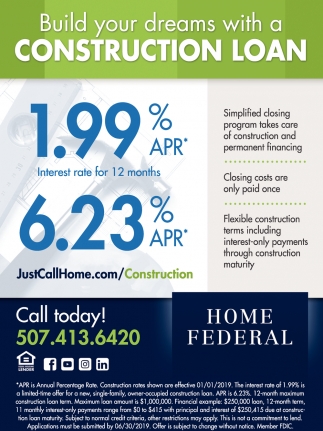

One of the most fascinating positives you’ll be able to take advantage of is leaner rates. More often than not, USDA pricing try all the way pyday loans in South Windham down and a lot more glamorous than just Traditional home loan cost if you don’t FHA mortgage rates.

You might seek advice from the local lender what the latest pricing was if in case their in a position to secure you the best price you’ll. Prices can sometimes times be available cuatro%. There are many different issues that can apply to home financing rate such as for instance once the stock cost, the Federal shortage, and you will advance payment. These can the have an impact on mortgage prices.

No money Down

A special work with which is perfect for somebody thinking of buying a property is the fact that a USDA mortgage allows this new debtor the accessibility to putting 0% upon their brand new family. This is why you shouldn’t be afraid going house hunting.

There are many different first time homebuyers intimated by 20% off and you will believe that home ownership is beyond take all of them. Better its not if you’re considering a rural mortgage. You can lay more 0% off even though, indeed it is highly better if your be able to set a lot more off than faster. This is because their deposit try a factor that will apply to their interest rate, however, a good USDA Home loan has been good choice for anybody who can’t afford an enormous deposit.

As compared to FHA and old-fashioned fund the sole other financial alternative which allows a purchaser to spend 0% down is the Va Financing. Virtual assistant Fund are merely offered to military Pros and if you’re maybe not an experienced an effective USDA mortgage is your next best option to buy a property with 0% Down.

This program helps make property affordable and accessible. It is specific the reason for the latest USDA Home loan Program. While a decreased so you can Average Income family and you also do not have money to get down for a house, this might be an amazing selection for your.

Fixed Rate Home loan

USDA finance including succeed people to have the ability to get an effective house or apartment with a 30 Year fixed rates home loan. Thus you will be able to go to your family and have only a small amount monthly payments you could.

What’s more, it means along the lifetime of your loan their money won’t changes. This might be a stylish selection for really first-time homebuyers that are lower income and you may cannot manage huge monthly payments. A predetermined price mortgage might be best for you for folks who intend on purchasing very long in the home which you purchase.

Financial Accessability

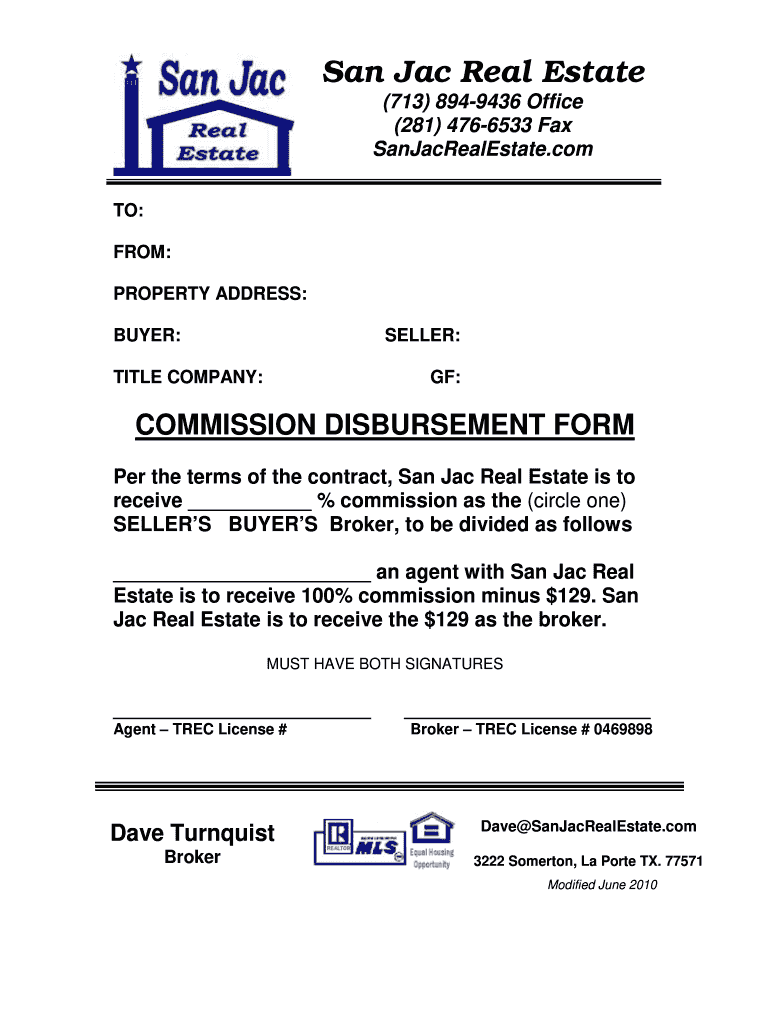

This new USDA will never be the only real group letting you on your home loan travels but not. Determine if your qualify after which get in touch with an area bank to help you start the method. Once the just like the USDA could be the providers you to finance the brand new financing. The latest USDA in the first place install the application form in order to assist accepted loan providers inside delivering lowest- and you can reasonable-money homes the chance to very own adequate, modest, decent, safe and hygienic homes because their no. 1 house during the eligible outlying elements. Your financial plus the USDA would have to collaborate so you’re able to help your house be to purchase trip an emergency.

Rural Traditions

USDA Finance are among the most glamorous options for someone thinking of buying their house from inside the an outlying town. These were financing specifically made to aid support the outlying area. Brand new USDA was a nationwide approved institution one aids rural areas with over lenders even if. He’s toward an objective.