Family equity loan

A home collateral mortgage is a type of loan in which you use the new guarantee of your house to locate a loan. The interest prices of property collateral financing are often highest. People pick household collateral funds for various aim, such as for instance on upgrade of its residential property, debt consolidation reduction, an such like.

For it, you have got to learn the property value the fresh equity against which you are able to borrow funds. Most of the lenders wanted fifteen to twenty% of guarantee built up inside your home to offer a property collateral mortgage.

There is certainly a very easy way to determine our home security of your house. It can be determined because of the deducting the borrowed funds balance about worth of the house.

What is HELOC?

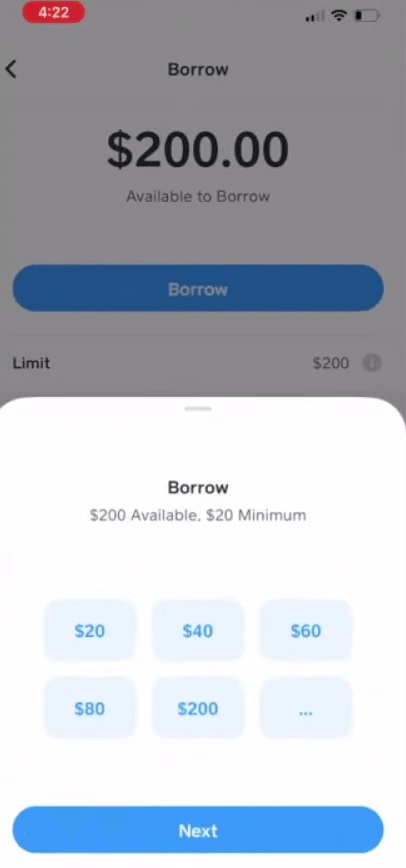

HELOC is actually a personal line of credit you to attributes similarly to an excellent mastercard. You might withdraw any amount of money you want to, plus desire will be variable in cases like this; that’s, it can fluctuate sporadically.

If you purchase a property security mortgage, it could help you in lots of ways, for instance the currency you get regarding loan is going to be accustomed spend highest expense otherwise major costs. It’s also always remodel your property, which will help inside increasing the total value of the new

It is because, within this mortgage, your residence serves as equity to provide you with the borrowed funds, that’s different from other sorts of loans where other assets are utilized as collateral.

Into the a home security loan, your property acts as the fresh security to your financing. When the, in any case, the borrower doesn’t pay his monthly instalment or perhaps is not able to spend their month-to-month instalment, then your financial will get foreclose their house. Therefore, it will be a major loss into borrower, and biggest advantage from their life could be shed.

It is an accountable activity where you have to repay the brand new borrowed count also the recharged level of interest.

The interest rate off household guarantee financing and you will HELOCs are basically less than that of other kinds of financing, instance signature loans, nevertheless rates may not be fixed.

Additionally is dependent on the market criteria; which is, if the property value your home grows, then your value of your own guarantee might increase and you can vice versa.

When taking a house security financing, your house is into target. Unless you pay-off the borrowed funds timely, your property is generally foreclosed.

Applying for family guarantee and you can HELOC

Once you have made a decision you want to track down property guarantee financing otherwise an excellent HELOC, the initial step is to get loans Moulton AL a lender. The brand new debtor will want to look at the several lenders and you will compare the eye costs as well as their charge.

You have got to complete the applying where some documents are expected. And, you have to complete your own borrowing from the bank, house worth, etcetera. This step is quite much like the process implemented throughout providing any other kind out-of loan.

There is no need to-do much once you have occupied from the software to suit your financing. The lending company goes using your documents and you may check them to see whether your be eligible for the loan or perhaps not.

Alternatives to using house guarantee

Good revert mortgage is also a variety of mortgage that is intended for dated individuals, essentially of one’s age of 62 years or higher. The same as a home guarantee mortgage, they could have fun with their house security while the equity locate a great financing. But rather than equity, the fresh borrower does not have to spend the money for loan instalments all month; instead, the complete count was reduced if the residence is sold or the debtor actions to a new place otherwise passes away.