Researching Credit Unions to Old-fashioned Banking institutions

Selecting the most appropriate standard bank is essential, as at the end of a single day, visitors wishes a beneficial financial companion to hang the difficult-won money. , a lot of people have a tendency to pick between a financial and you may a card partnership. Although they may seem comparable on top, there are lots of significantly more nuanced variations one we’ll undergo below:

Ownership

One of the biggest differences when considering banking companies and you may borrowing unions was their control build. Banking institutions try belonging to dealers, which have an aim of promoting payouts with the shareholders. Oversight off corporate financial functions exists by the a panel out of Directors which drive the financial institution towards the earnings. On the other hand, credit unions are not-for-earnings financial cooperatives and belonging to its members. That always means that credit unions offer cheaper banking solutions, most readily useful rates on the savings, superior support and you can solution on the players – who happen to be and the investors and therefore are supportive of its regional organizations. Borrowing from the bank Unions was also influenced because of the a board regarding Directors, but they are opted because of the credit union participants. So it contrast regarding ownership and you can governance away from banks as opposed to borrowing unions usually causes a much better, far more personalized financial experience away from borrowing unions.

Banking Things

These days, extremely borrowing unions give all exact same services as their financial alternatives. Yet not, they are usually confronted by higher rates for the discounts accounts and lower prices on the fund.

Interest levels

As stated, credit unions generally render straight down interest levels toward money, than just old-fashioned financial institutions. How does that work? Because borrowing from the bank unions try non-funds, they often times do the profits’ generated by their products or services and make use of these to bring reduced rates of interest. This really is one of the main aggressive pros that credit unions keeps more antique banking companies.

Financial Fees

Since borrowing unions occur to assist its members flourish economically, they will certainly typically bring faster charges for their participants, also totally free attributes occasionally. Traditional banking institutions typically have a global percentage associated with the its membership loans Red Feather Lakes CO if you don’t satisfy a couple of requirements, such as lowest balance requirements, and often fees higher charge getting popular financial problems such as for example insufficient fund, because of inspections, prevent costs, etc.

Support service

That have a purpose focused on support their players, borrowing from the bank unions almost always has an advantage when it comes to service and you can assistance. After you name a credit commitment, might communicate with somebody who lifetime and you may performs on your own area, as opposed to a local otherwise offshore call centre you to definitely antique banking companies may use, for them to better know your specific demands.

Prevalent Supply

Extremely credit unions are hyper-surrounding, if you get out regarding condition, or travel from your city, you are able to lose the capacity to directly visit a part of borrowing union. Bigger banks normally have branches and ATMs based in most major towns and cities. But, most credit unions participate in a network out of surcharge-free ATMs, possibly 50,000+ and you can expanding, also shared branching potential. Mutual branching lets borrowing relationship people the capacity to go to yet another borrowing partnership regarding network to procedure financial transactions. Plus, on expansion regarding digital banking and you may adoption away from technical of the extremely borrowing unions, financial having a card commitment is possible irrespective of where your home is, move otherwise travelling.

Choosing the right Banking Lover

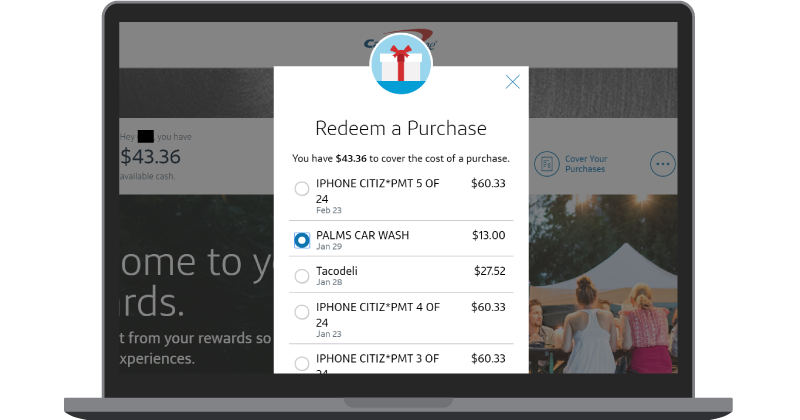

Typically borrowing unions lacked some of the mobile and technology provides the traditional banking companies given. Although not, that’s no longer the situation. Really Borrowing Unions possess a full suite regarding on the internet and cellular financial services and products, in addition to virtual account opening, and, just like their banking competitors. Very don’t let driving a car off trouble stop your, very credit unions are really easy to access.